No products in the cart.

Write Off Vs Disposal of Fixed Assets Leave a comment

Content

The capitalized cost of an asset is written off periodically, or depreciated, in a manner that is systematic and rational after consideration of any salvage values (see paragraph 30.75). Allocating the cost of a long-lived asset over the accounting periods which the asset is used matches its cost with revenue generated throughout its useful life. The Federal Reserve System uses the straight-line method for depreciating fixed assets. Compare the cash proceeds received from the sale with the asset’s book value to determine if a gain or loss on disposal has been realized. These types of entries reflect the current fair market value of a fixed asset. You’ll need to make a series of accounting changes to determine if there is a gain or loss from revaluation. When the company decides to dispose off the asset, it is required by the company to remove it from the accounting records and should not leave any trace of it behind the balance sheet or the financial statements.

To generate this report, start the transaction by double clicking the menu path below or by typing the transaction code in the Command box and pressing Enter. In the case where the asset is sold by UNDP and the funds from the sales will be received via the Service Clearing Account NO Sales Order will be raised.

What Is a Fixed-Asset Accountant?

Anything under construction exists in an accumulation account (for example, Construction-in-Process) until the work is complete. Upon completion, an accountant will move the asset to the appropriate fixed-asset account. There was no depreciation expense in July because the asset was sold on July 1. (We could have omitted the line “Depreciation Expense”.) Also, the current assets and current liabilities did not change in July. There were no revenues, expenses, or gains, but there was a loss of $180 on the sale of equipment.

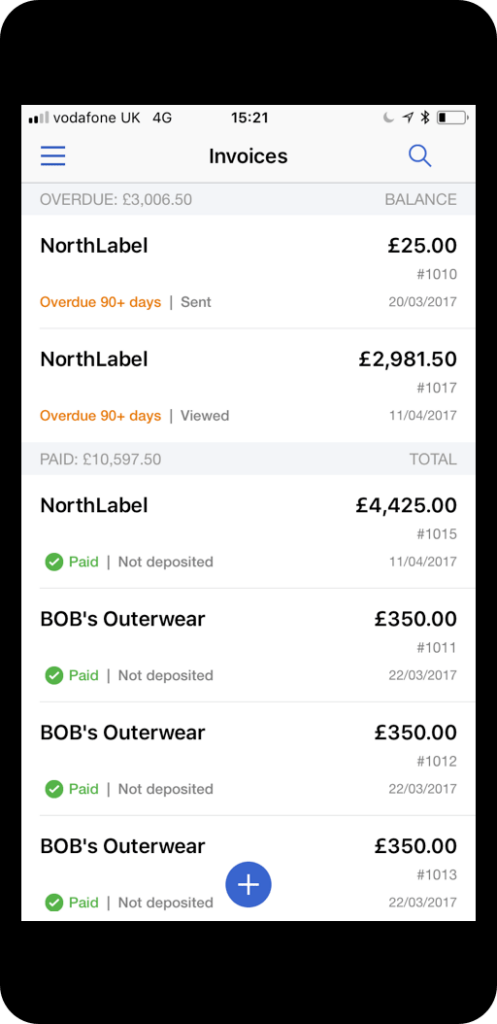

- A sales invoice is created using the Disposal Item as the line item, and the asset status is set to Disposed.

- Once the test mode for all assets is complete, verify that the amounts to be posted have been calculated properly.

- A foreground test run limits the number of assets being processed to only 1000 assets and provides immediate results to the user.

- And when the assets are no longer needed since they could not be used and considered as not generating any benefit to the company.

- This would only be applicable when the initial VAT at time of Purchase of your Asset was also processed as being Outside of Flat Rate (Value of purchase exceeding £2000).

- Asset disposal is applied for both accounting and alternate/tax methods, where the amount sold is separately calculated for each of the methods.

There may be other differences and exceptions depending on the type of assets, such as sale of cars and property. VAT is usually due on the sales of assets by VAT registered businesses. If an asset still has some value and you decide to sell it, you must record this in your accounts as well. Motors Inc. owns a machinery asset on its balance sheet worth $3,000. Let’s consider the following example to analyze the different situations that require an asset disposal. A fixed asset does not necessarily have to be fixed (i.e., stationary or immobile) in all senses of the word.

Retire the Asset in Asset Accounting Module

Double click all WBS elements to ensure that System Statusis REL and that the Applicant no., Responsible Cost Center,Business Area, Functional Area are correct. For each WBSE that is not at the lowest level, expenditures should not be posted. Review the list of projects and WBS elements to ensure completeness. Icon to save your internal order and Asset under Construction. You should see a message at the bottom of the screen showing your Internal Order number.

- All values should normally be defaulted based on the Asset Class.

- No asset exists in the initial planning and R&D stages, so you must expense costs.

- Remove the asset from your books, but record the payout as a proceed.

- On the other hand, disposal is at the discretion of the company.

- A bad debt write-off can occur when a customer who has purchased a product or service on credit is deemed to have defaulted and doesn’t pay.

- You should see a message in the status bar similar to this, and the Project Builder screen will be closed.

Upon https://intuit-payroll.org/ing your Other Receipt, you will now have the option to tick the Outside of Flat Rate option. Over time it has depreciated in value by £8,000 and is now worth £2,000.

List of Fixed Assets in Accounting

For example, if a fire destroyed the same $6,000 classroom but the payout was $7,000, you have a gain in proceeds of $1,000. For example, if insurance pays $4,000, record a loss of $2,000. The remaining life is how many years from the purchase year you assume are left. This method writes off more of the cost in the early years and less in the later years. Explains Riley Adams, a licensed CPA in the state of Louisiana working as a senior financial analyst for Google in the San Francisco Bay Area. He writes the personal finance blog Young and the Invested, which is dedicated to helping young professionals find financial independence and explore entrepreneurship. Usage defines whether an asset is operating or non-operating.

- The details requirements and processes on impairment refer to the Corporate Guidance on Impairmentand Property, Plant and Equipment.

- Clear this box to itemize each asset for disposal on the invoice.

- Sinra Inc buys a machine for $200,000 and recognizes $20,000 of depreciation each year for the next 10 years.

- If your organization builds an asset and you borrowed money to pay for the work, the cost comprises all components, including materials, labor, overhead and any interest expense.

- Entities record their purchase of a fixed asset on the balance sheet, Asset purchases used to be noted on a sources and uses of funds statement, which is now called a cash flow statement.

Fixed assets most commonly appear on the balance sheet as property, plant, and equipment (PP&E). Even though fixed assets are not considered sensitive assets that could easily convert into cash. In some cases, other real estate will include buildings with tenants. Income and expenses involved in operating buildings purchased after 1976 should be functioned through current expenses.

Journal Entry for Fixed-Asset Depreciation

A special What Is The Difference Between Fixed Asset Write Off And Disposal? code exists for determining where each WBS Element derives its budget from. This enables FM and GM Users access to allocate budget to projects without giving them access to change any other project fields.

What type of account is disposal of fixed assets?

A disposal account is a gain or loss account that appears in the income statement, and in which is recorded the difference between the disposal proceeds and the net carrying amount of the fixed asset being disposed of.

Execute transaction code ABAVN to start retirement of the asset. During this task the Users will run the equipment/asset report and review the status to ensure the status is relevant to retirement. Note that posted documents for Non-Budget Relevant and for Budget Relevant Transfers will be the same. The difference will be in Transaction Types recorded for Asset Transaction and the fact that Budget Relevant Transfer requires Funds Commitment and manual recording of Revenue. In the above report, also note the Document Number for FI Posting, and using FB03 transaction, review posting documents. This process should not be followed in the cases where a minor adjustment to accumulated depreciation posted in the current year is required as a result of an adjustment of useful live . Review Asset using transaction code AW01N, by looking at Special depreciation and Transactions.

What’s the Difference Between Total Assets and Net Assets?

To comply with the requirements set forth by the Government Accounting Standards Board, public entities must accurately track assets from acquisition through disposal. Often times, these organizations have strong policies and practices in place for everything from procurement to active asset inventory but have a harder time managing the disposal of assets. Noncurrent assets are a company’s long-term investments for which the full value will not be realized within a year and are typically highly illiquid. Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash.